Some thoughts on stablecoins

It turns out that stable coins are a fascinating subject. You may say, what's so fascinating about something that's stable by definition? Thread 👇 // @vrypan→

For one, the various implementations. Take DAI, USDT, USDC, SUSD, TUSD, BUSD, GUSD and the rest. In theory, they are 1-1 to USD. But you get algorithmic vs centralised implementations, each one with its pros and cons. // @vrypan→

And then, even for the centralised ones, you get to have different jurisdictions. You want a stable coin backed by a company regulated/audited in the US or not? How much do you trust the backer (if centralised) or the algorithm (if decentralised)? // @vrypan→

Also, you have to consider liquidity and integration with marketplaces, exchanges and other services. Will you be able to convert your stablecoin to the desired price? Which one(s) are supported by the services you are interested in? // @vrypan→

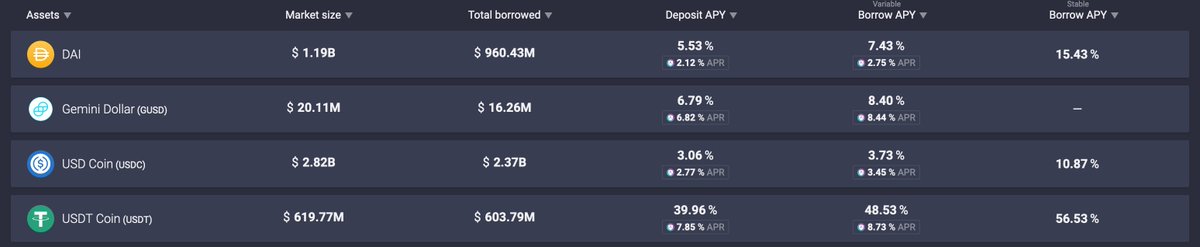

I think that nothing illustrates these differences than this. This is the current deposit/borrow APY on aave. In theory they are all the same, but the APYs differ based on demand. app.aave.com/markets // @vrypan→

You may think that stablecoins are second class citizens compared to the reference currency. But in some cases they are better. For example, there is no KYC. Remittances are a breeze and you don't have to convert to the local (usually much weaker currency). // @vrypan→

Sidenote on remittances: This is a huge and critical economic activity for a very big percentage of the global population. For example, in Nigeria official remittances have exceeded oil revenues for multiple years. See www.pwc.com/ng/en/pdf/the-econ... // @vrypan→

I'm looking forward to stablecoins pegged to other currencies. I for one, would love to have one (or more) EUR stablecoins. Is someone working on this? // @vrypan→